Navigate New York DFS Section 500 with Confidence

Section 500 compliance isn't just about having policies on paper—it's about building operational cybersecurity programs that work in practice. Many organizations struggle to bridge the gap between regulatory language and real-world implementation.

Understanding NYDFS Section 500

The New York Department of Financial Services Cybersecurity Requirements (23 NYCRR 500) establish minimum standards for protecting consumer data and ensuring the safety of New York's financial services industry. If you're licensed or regulated by NYDFS, compliance is mandatory.

Complex Requirements: Translating regulatory language into practical controls is challenging

Documentation Gaps: Many firms have policies but lack operational evidence of compliance

Resource Constraints: Small firms need efficient compliance without enterprise-level budgets

Your Practical Compliance Partner

We don't just advise—we help you build, document, and maintain cybersecurity programs that meet Section 500 requirements while fitting your operational reality.

How We Support Your Compliance

Actionable Control Translation

We translate Section 500 requirements into clear, implementable controls your team can execute

Program Development & Documentation

Build comprehensive cybersecurity programs with documentation that meets NYDFS expectations

Risk Assessments

Conduct thorough risk assessments aligned with regulatory standards and your business reality

Ongoing Compliance Support

Maintain readiness with continuous guidance, updates, and operational compliance support

Specialized Expertise

We focus exclusively on cybersecurity compliance for financial services, with deep expertise in NYDFS Section 500 and related state regulations.

We Understand Your Challenges

Real problems. Proven solutions. Immediate results.

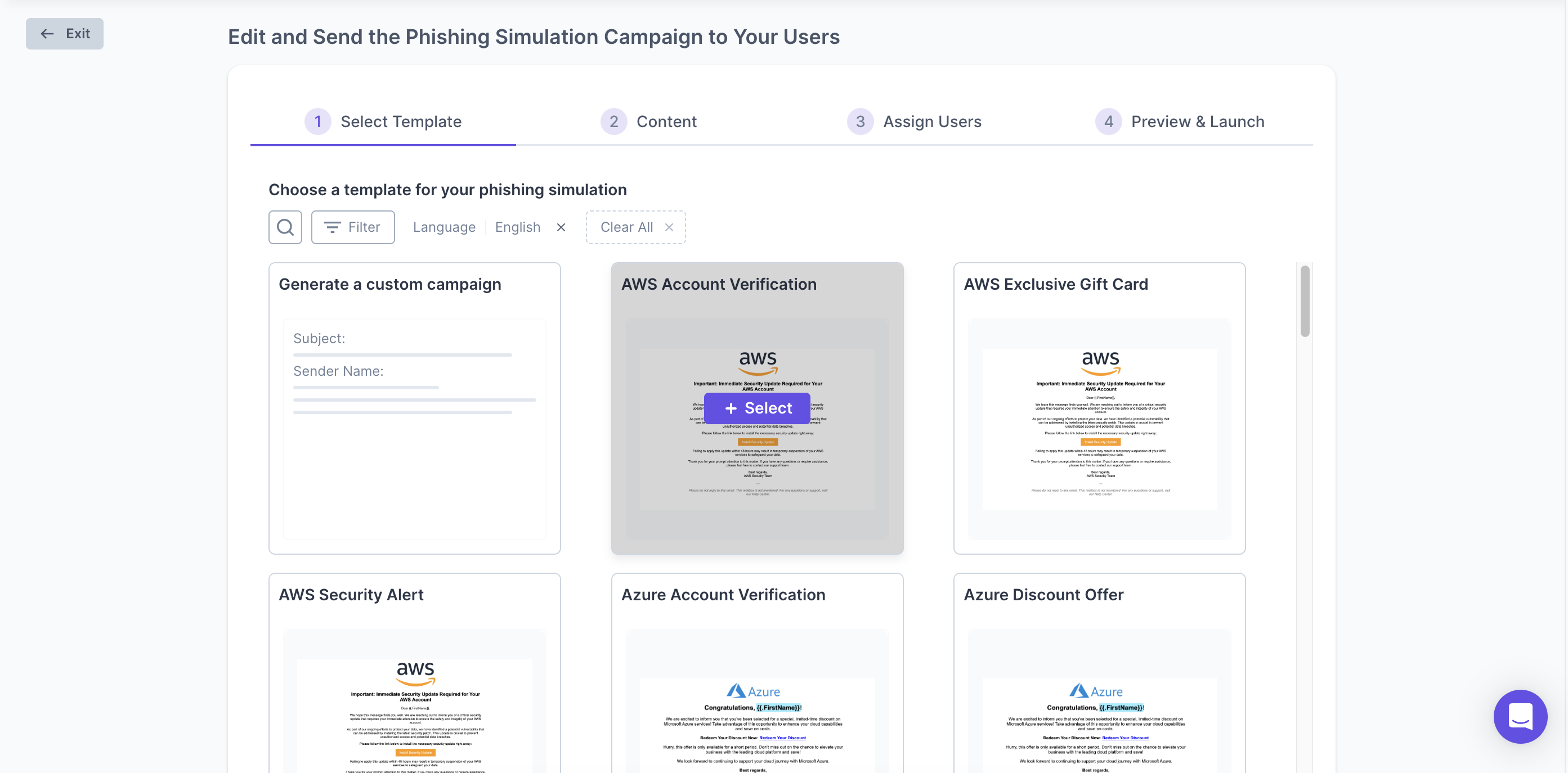

Phishing Protection

The Problem

65% of cyber attacks start with phishing

Our Solution

Test your team before hackers do

- Company-wide phishing test

- 2-week protection trial

- Vulnerability report

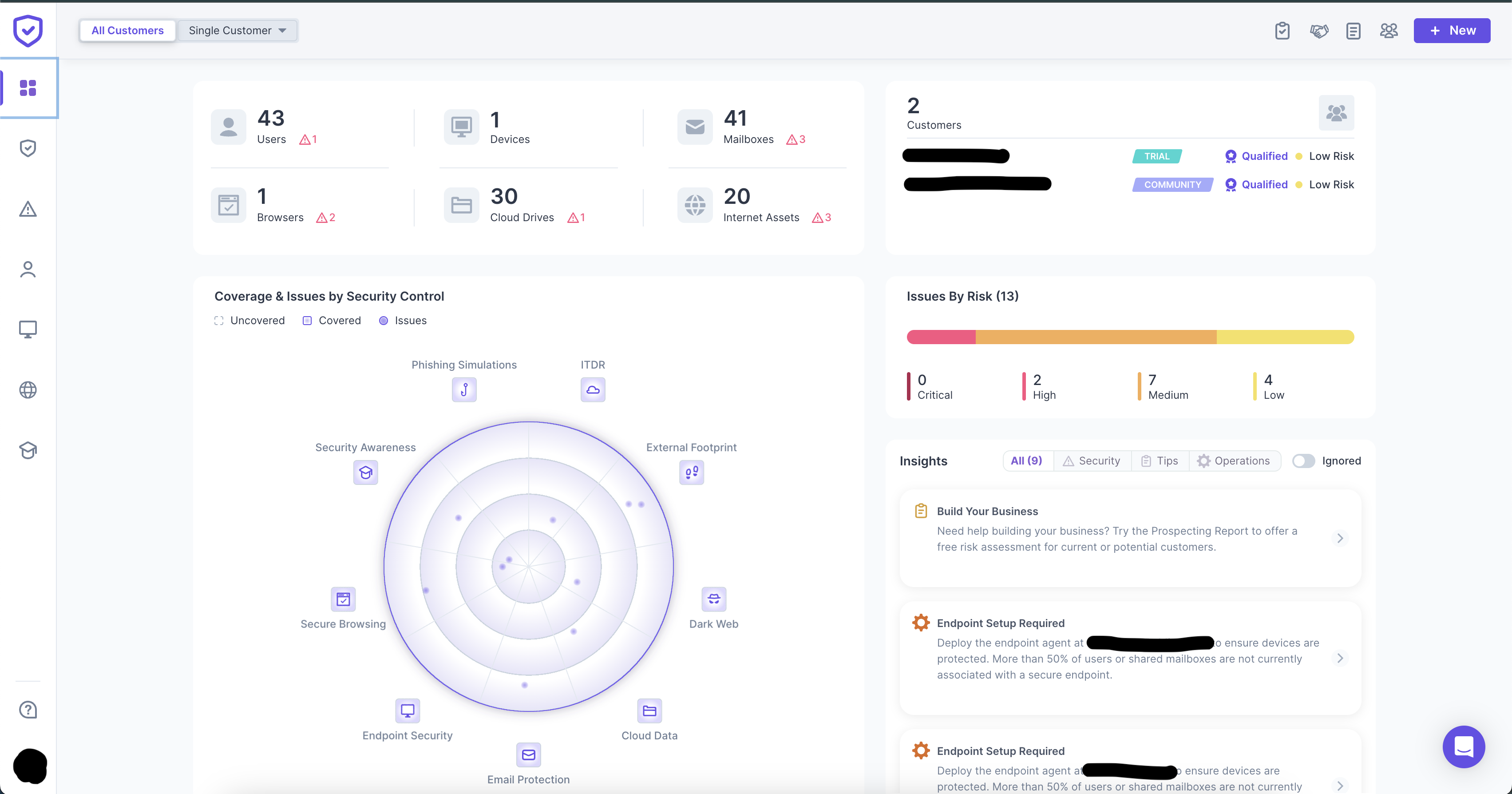

24/7 Protection

The Problem

Threats don't sleep - neither should your security

Our Solution

Round-the-clock monitoring & instant response

- 24/7 monitoring

- Instant response

- Monthly reports

Volume discounts available for 20+ users

Get Protected

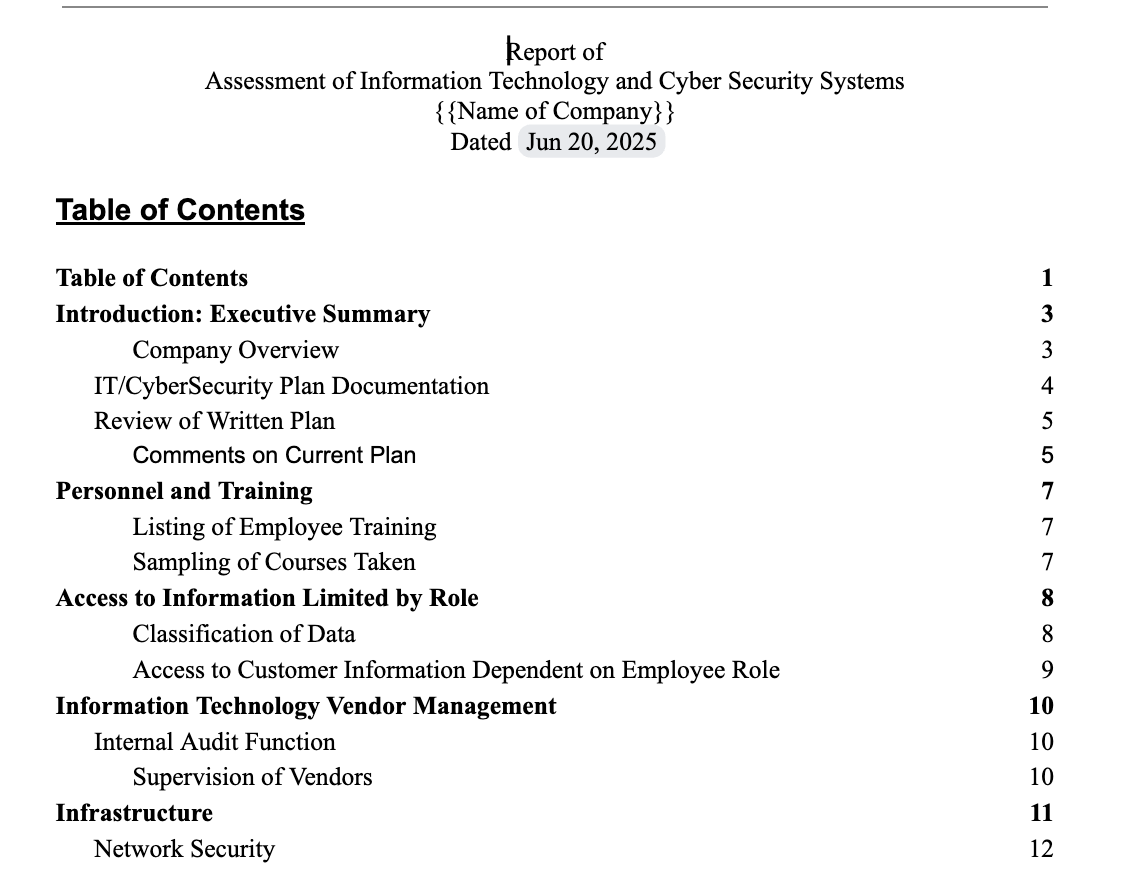

Risk Assessment

The Problem

State examiners require recent security reports

Our Solution

Get examination-ready in 48 hours

- Full audit

- Action plan

- Compliance check

Policies & Procedures

The Problem

Missing policies = compliance failures

Our Solution

36+ ready-to-use security policies

- 36+ policies included

- Fully customizable

- GLBA compliant

Have a Unique Challenge?

Let's discuss your specific security needs - we'll create a custom solution

Schedule CallWhat Our Clients Say

"Saved us from a $500K ransomware attack. Best investment we ever made."

"Setup took 2 hours. Haven't worried about cyber threats since."

"Passed our regulatory exam with flying colors thanks to their compliance tools."

Trusted & Certified

Don't Wait for an Attack

Financial firms are attacked every 39 seconds. Get protected before you become the next target.

Live Threat Feed

Ransomware Attack

CRITICALCredit Union in Texas

2 min ago

Phishing Email

HIGHInvestment Firm in NY

5 min ago

Data Breach Attempt

CRITICALMortgage Company in CA

8 min ago

Malware Detection

MEDIUMFinancial Advisor in FL

12 min ago

847 attacks blocked today