Your cart is currently empty!

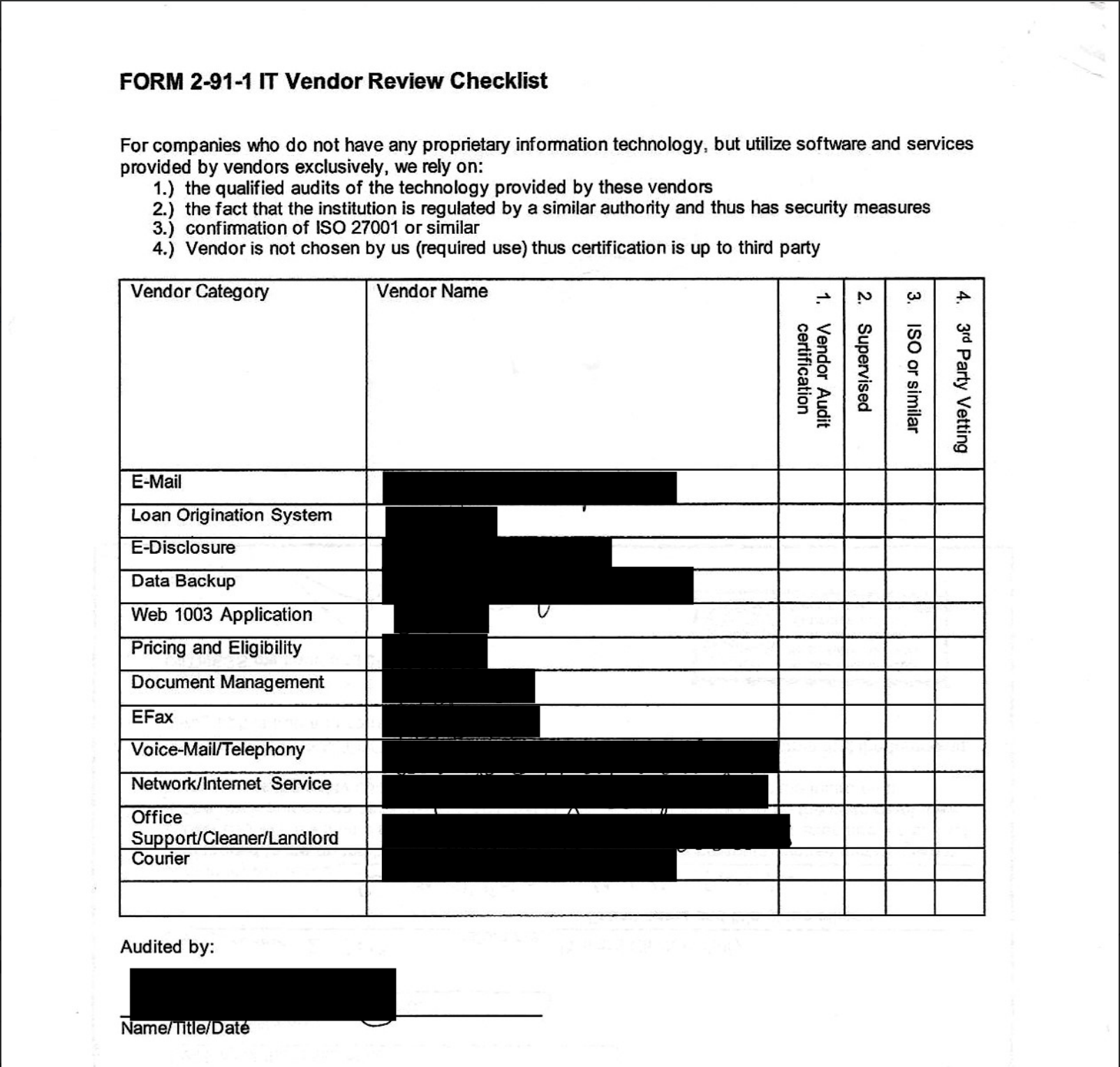

Manage vendor risk and secure your supply chain with thorough vendor vetting, annual reviews, and cloud security configuration assessments.

Third-Party & Supply Chain Risks

Overview:

Your security posture isn’t limited to your own systems—it also depends on the vendors, contractors, and service providers you work with. A compromise at one of these partners can serve as a stepping stone for attackers to infiltrate your environment. These risks compound when vendors have access to sensitive data or direct integration with your systems.

Why Small Financial Firms Are Vulnerable:

Many small firms rely heavily on third-party services for functions like loan processing, payment systems, cloud storage, and IT support. However, vendor security standards vary widely, and without a structured vetting and review process, firms may unknowingly partner with providers that have weak security practices. In the eyes of regulators, you remain responsible for the security of your data, even if the breach originates from a vendor.

How MortgageMoat.com Helps:

We implement a complete vendor management process that includes initial due diligence before onboarding, contractual security requirements, and scheduled re-vetting of all existing vendors—at least annually. Our process includes reviewing vendor security certifications, incident history, and compliance posture, so you have documented proof of oversight for audits.

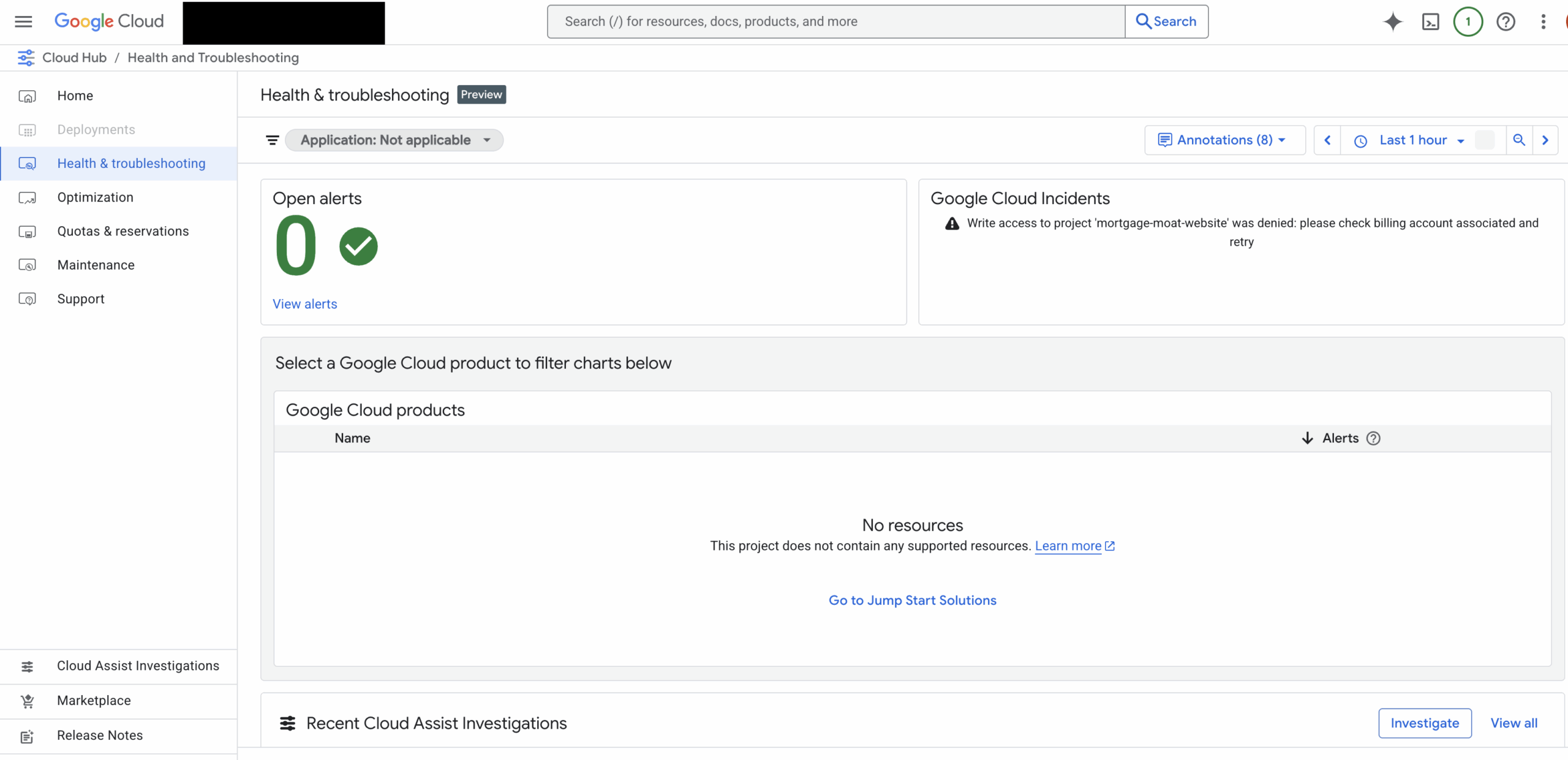

Screenshot Taken By Ethan Houley.

Cloud Misconfigurations

Ethan Houley.

Overview:

Cloud services offer flexibility and scalability, but they must be configured correctly to be secure. Misconfigurations—such as granting overly broad permissions, failing to enable encryption, or leaving storage buckets open to the public—are among the most common causes of cloud data breaches.

Why Small Financial Firms Are Vulnerable:

As more operations move to the cloud, firms without in-house cloud security expertise risk exposing sensitive client data. Misconfigured settings can allow unauthorized access or make confidential data publicly accessible without your knowledge. These incidents can trigger regulatory investigations, fines, and loss of client trust.

How MortgageMoat.com Helps:

We perform detailed cloud configuration reviews, ensuring proper permission restrictions, strong encryptions, and active monitoring. Our services help align your cloud environment with industry best practices and your compliance requirements.